week26 was overall a groundbreaking week.

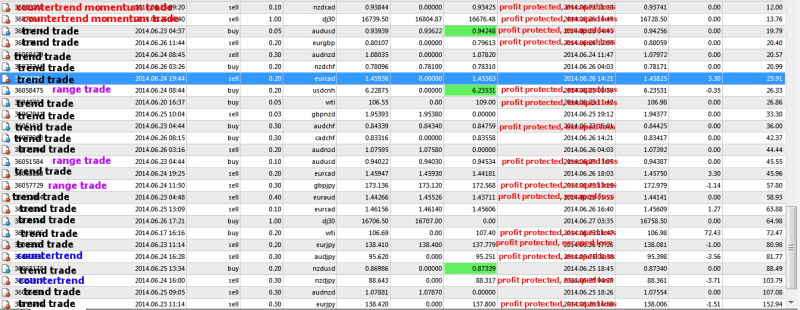

I had probably done 15-20 trades, more than the usual. Win-loss percentage is about 80+% about 4 losses to 16 wins.

However, this is to say that the RRR have been 1:1 and many of the times I took profit early instead of reaching the intended TP.

I am saying this is revolutionary for my trading because I have now developed a new edge to my trading repertoire: to be able to trade on the h1 with higher accuracy. I am looking forward to havea quicker account growth using this method, together with existing strong, reliable albeit slower swing trading.

Analysis of Wins and Losses under the new triggerpoint method using only h1 tf to trade.

Still some flaws in execution but signs are looking promising to include this style for the next coming weeks.

Losses

Wins

Conclusion:

Win % is 77%.

Profit factor is 1.33

median duration of trades ~ 12 hours

Losses are much fewer but they sting harder. This is the trail mark of a lower RRR. However, the root of problem lies not in lower RRR, but rather:

1) Problems in trigger. Over eagerness to get into risk. Senseless risk.

2) Occasional, uncommon hiccups in identification of trade/momentum.

but this is a new trigger for me, perhaps some excuses can still be made.

Wins are characterized by numerous early exits. However, many of these trades were also prevented from being SL by taking profits early, at a arbitrary pips range of say 35-50.

By constantly locking in profit, the account had grown consistently. I still believe this is a better way rather than just sticking to certain levels for tp.

What can be done better may be to stick to tp at set tp levels for very clear trending trades instead of trying to ‘ milk’ these trends; exiting and then assume they wil retrace to enter again.