w1

clear cut uptrend on the week chart. Last week price closed as a hammer, indicating of strong support despite reaching

a big level of 20,000. It is hard to say when the trend has ended.

h4

Price did a retrace on monday, but on tuesday completed a bullish day expansion which also broke a bullflag.

It also completed an inverted head and shoulder, aligned it with the potential upthrust from this bullflag.

Stop Loss can be either set at 19000 , ie btm of bullflag or btm of right shoulder.

updated 200515

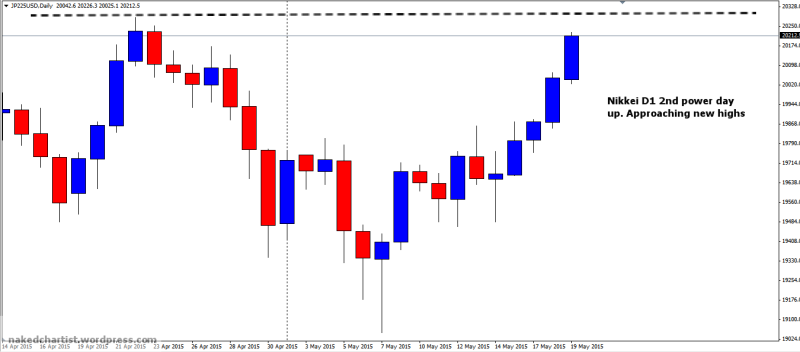

D1

runaway winner. Trade still in progress since initial setup.

updated 210515

exited at top. This was a good trade from the start of the hammer.