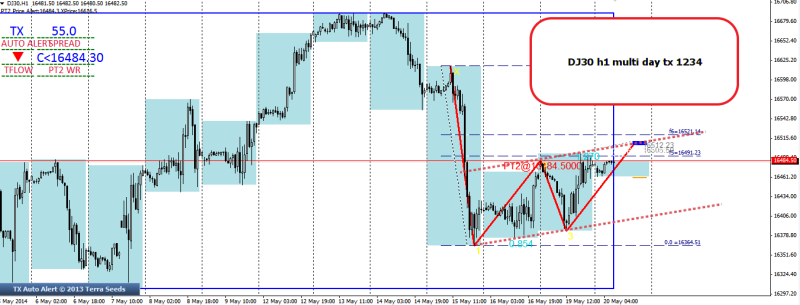

So tried to apply on charts and this was what I got:

Dow Jones is uptrend. I will only look for hidden divergence on the downside of Osma.

Coincidentally, there is a potential wr2b with tx 1234.

There is a h4 bull flag as well.

This suggests there is a potential for bigger upside.

So how can I reconcile with the current h1 momentum to ensure i can go long without suffering drawdown at the initial?

I then use triggerpoint channel to get into my long,

which coincides with a h4 tx 1234 as well.

h4

h4 tx 1234 shows a promising trade

h1

triggerpoint provides the exact entry point and positions were triggered just before friday close.

A trade criteria

( to be reviewed)

trade outcome edited 030714

On one hand, it was great to see price had indeed moved out as planned. The revised A trade criteria has improved component that worked great.

On the other hand, sticking to the plan and having conviction in my trade bias will be something to continue to work on.

From trade outcome,

it seems that this upmove was so inevitable , so sure that I would have surely made the profits but then the waiting time, the slight misttimed Entry Point made the 2 days flactuation painful such that I gave up on the day and few hours just before the glory move came.

Summary

My conviction for the revised A trade criteria has increased.

But I have also identified this compulsive bad habit to be ” in the market” at most time for fear of missing out, such that ill-timed Entry Points had affected my psychological stability to hang on to the trades to see eventual success.

I must continue to work on:

RESTRAINING THE URGE TO GET INTO TRADE AT SUB-OPTIMAL PRICE