Week9 registered small profits and prevented massacre.

Was satisfied to see trade consistency coming back with no random trade entry and astute trade exit decisions.

1)USDCAD : +3 x 3 , CTT short but was BE. Nevertheless was excellent trade management

2)XAGUSD : -30 cents , too exited to trade on breakout, which was a failed break actually.

failure to subsequently trade out the bull trap that it become.

3)CADJPY : +65 , +77 , +75 nailed this pair with orthodox 1234 multi day bull trap

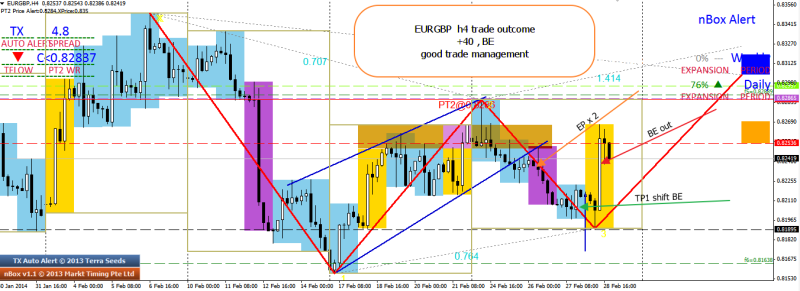

4)EURGBP : + 40 , BE +2 , follow plan to trade multi day 1234 with key resistance tested. Prevented losses by shifting BE correctly.

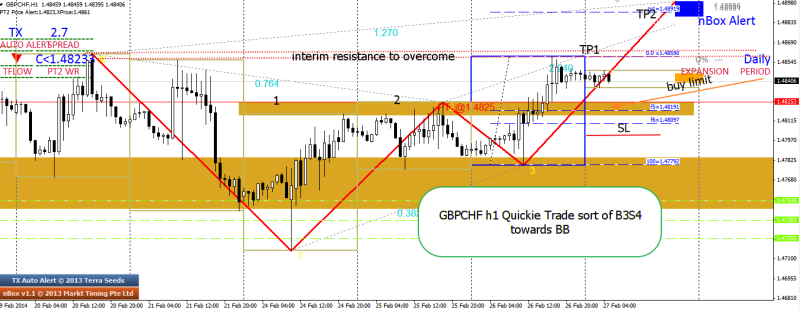

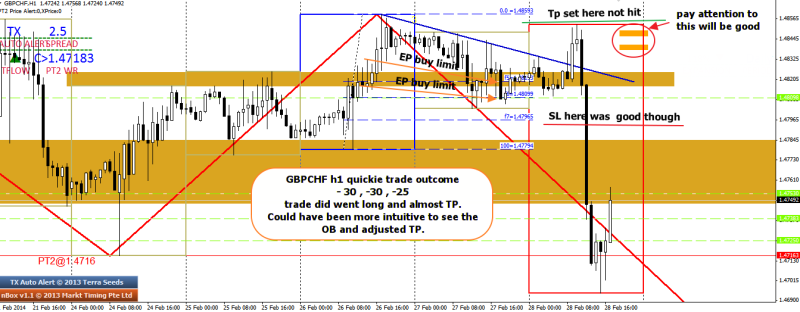

5)GBPCHF : -30 x 3 attempted quickie which did not succeed. Nevertheless almost hit TP ,but will need to take a constant look out for Orange Box. Will reflect on if WTT or CTT quickie makes a difference or not.

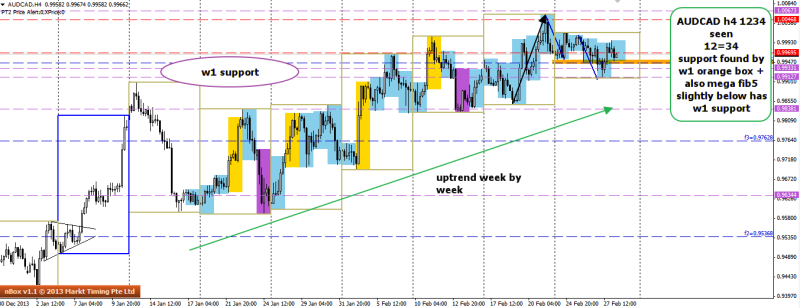

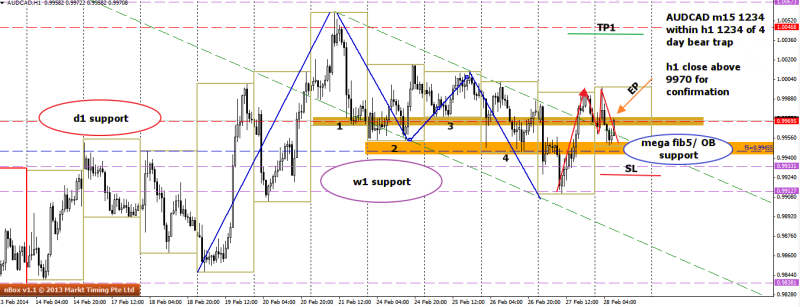

6)AUDCAD: -25 x 2 : orthodox 8 weeks up with multi day 1234 done with smaller 1234. But did not work out. No love lost.

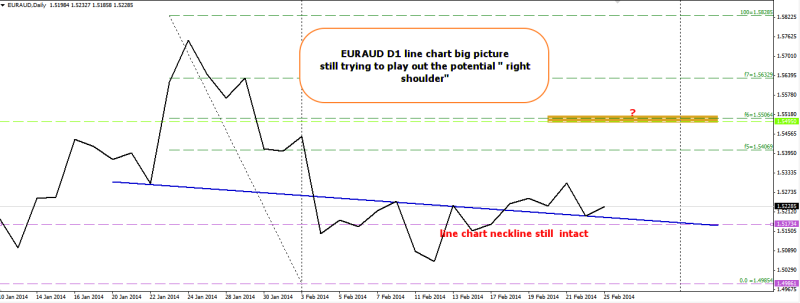

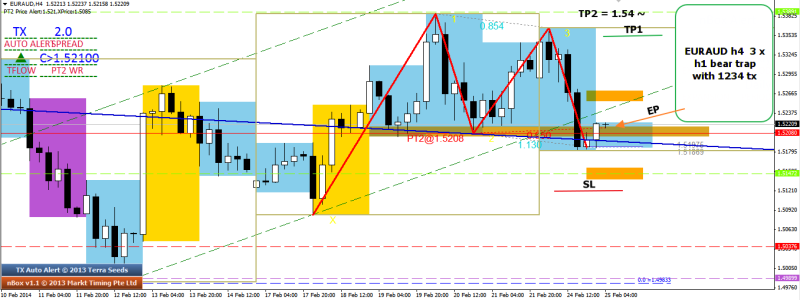

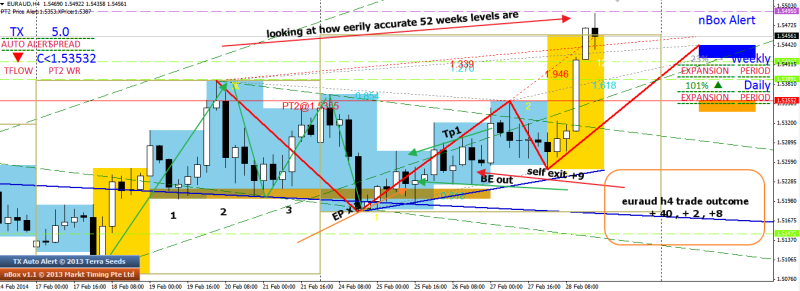

7)EURAUD: +40 , +2 , +4 manual exit: the only call that went against the community and was correct. However last pos did not manage to hold till TP. Price wise , was very volatile. Still it was a trade that boosted internal confidence and empahsized on the importance of trader’s independence.

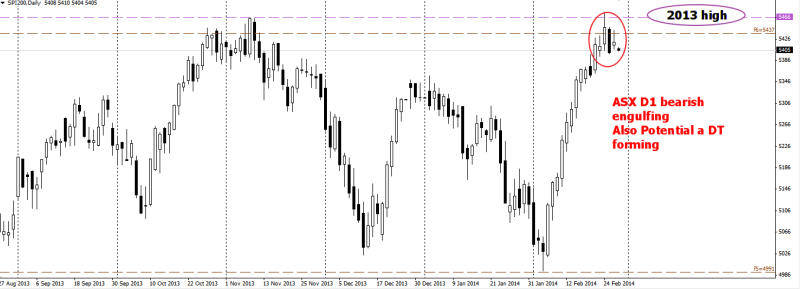

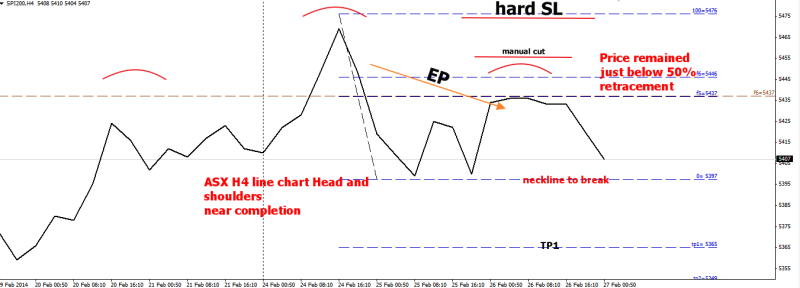

8)ASX : + 5 , +5 : Could have done better to TP more since it was heavy CTT. Greed got the better to TP more. will remember this trade.

9)CAC40 : + 10 : followed orothodox many weeks up and multi day 1234 wr. need to look harder at potential resistance for better TP.

What I did well :

Excellent trade entry at optimum price level

Excellent trade exit to avoid huge losses

Good trade management to shift BE

What i can do better:

Stronger in desire n mental strength to trust my analysis and ride out the winner