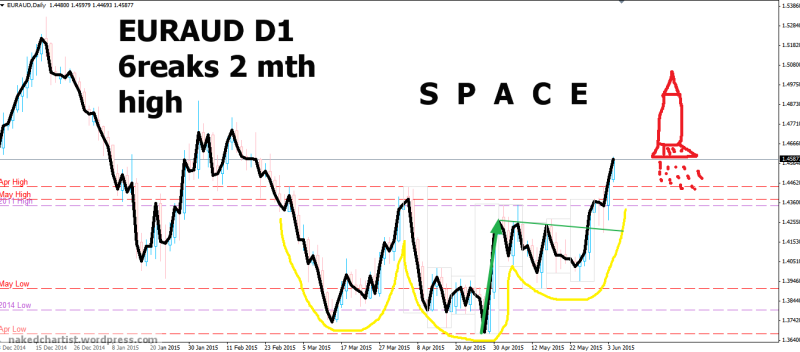

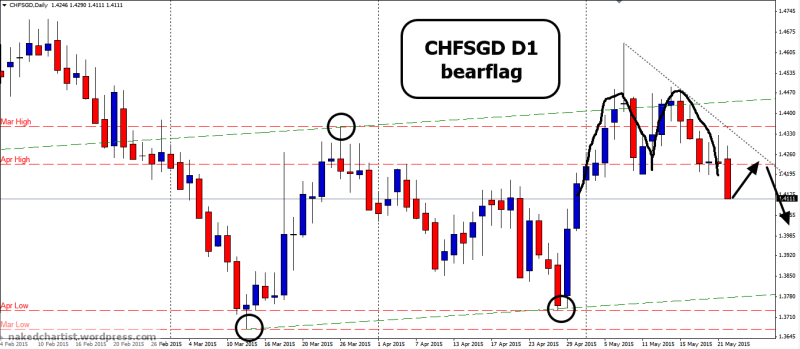

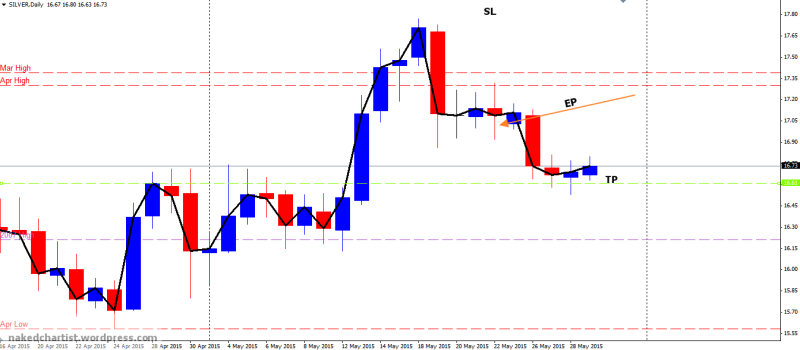

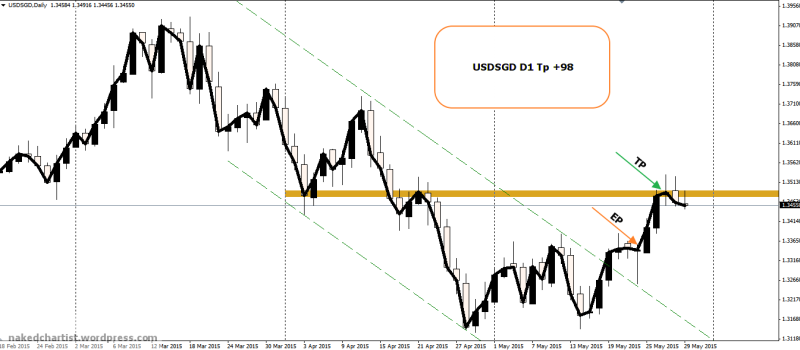

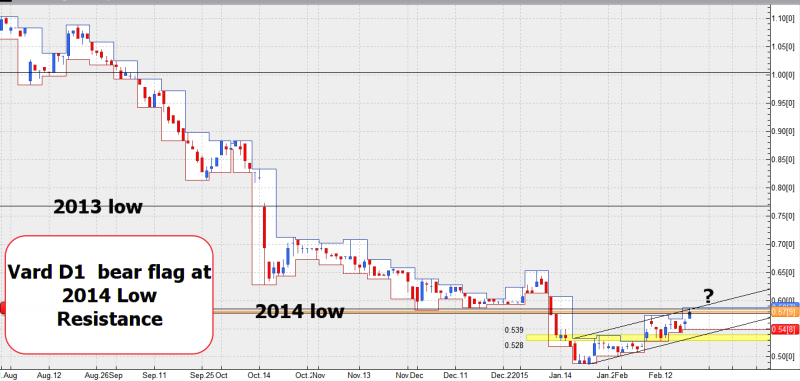

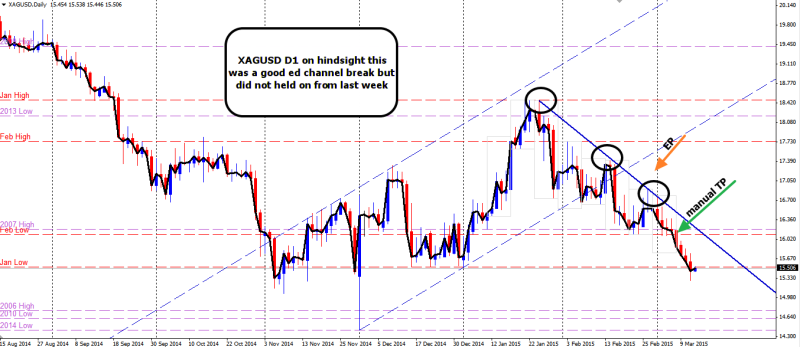

D1

Started off with an identification of the trend using zigzag dow theory. Price had completed an inverted head and shoulders

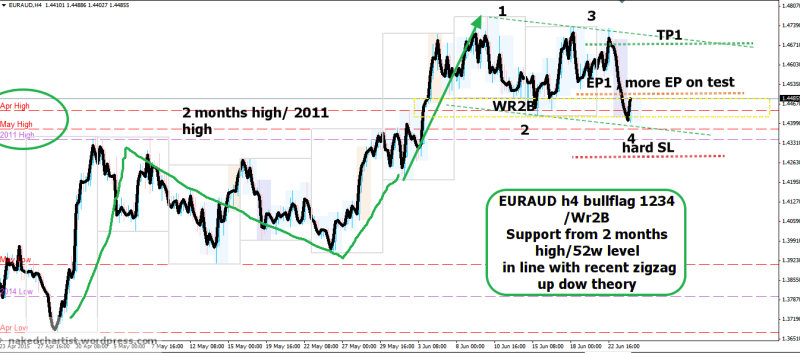

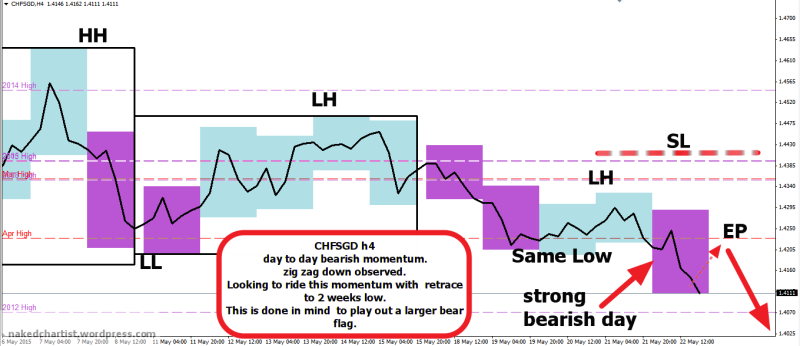

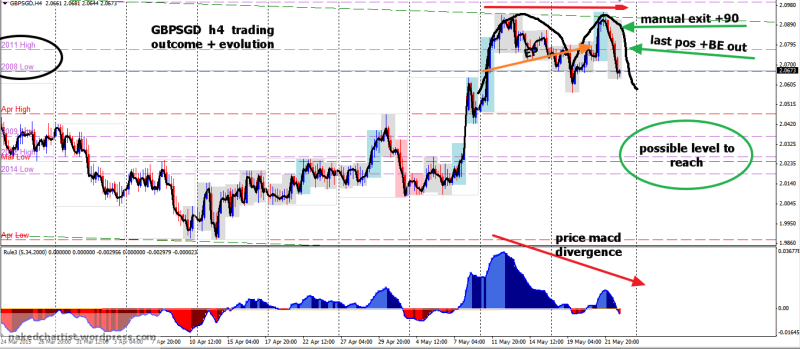

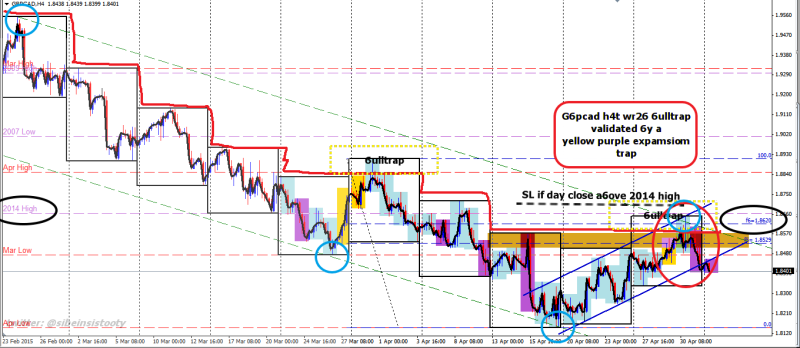

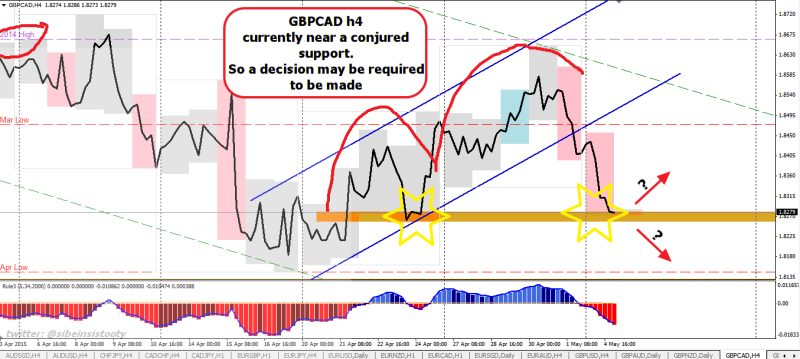

h4

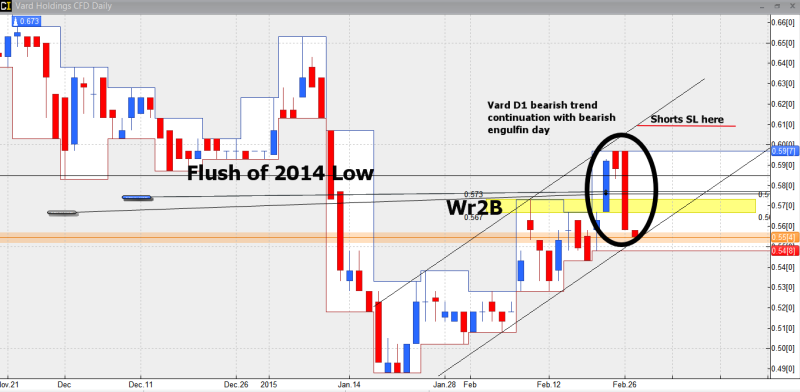

After several days of no signal for long, finally things began to happen.This was a nice and classic bullflag which I had seen it so many times, again and again. With my strong confidence in the support cluster, I no longer wait for a flush to confirm but will happen the moment i see a bottom. After all , I am only looking for a spurt of 100 pips each. Understanding that price moves in ebbs and flows, each 100 pips always will provide chance for another retracement entry. So in all , I could have traded several times within the story.

I was willing to add more on retrace, based on the macd divergence i see in the double bottom.

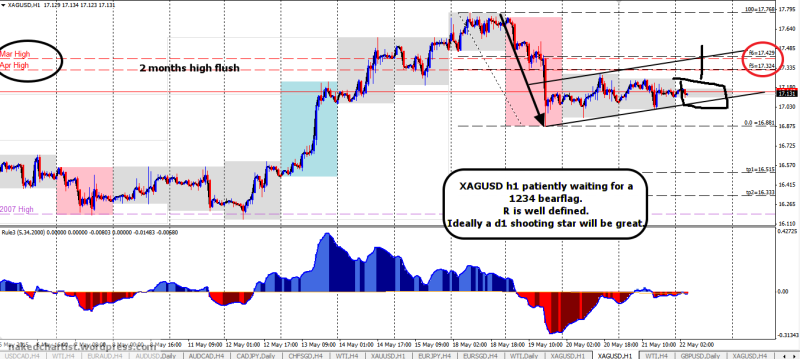

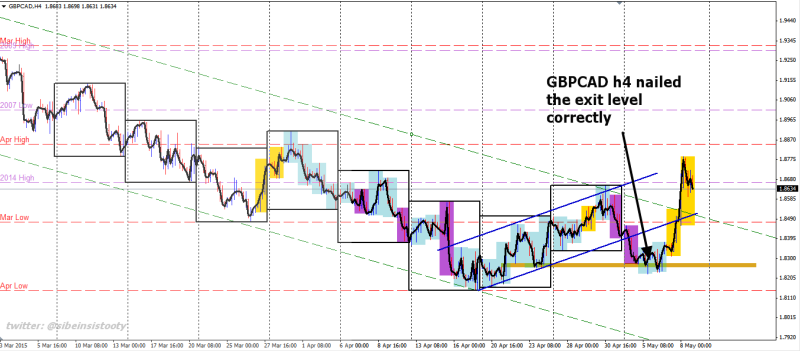

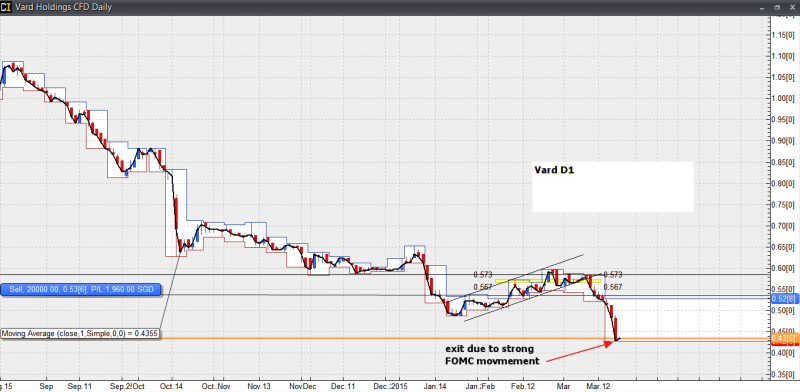

Outcome 270615

Outcome of this trade has been awesome. This was a good trade as this was a repeated price pattern and my edge continued to work.