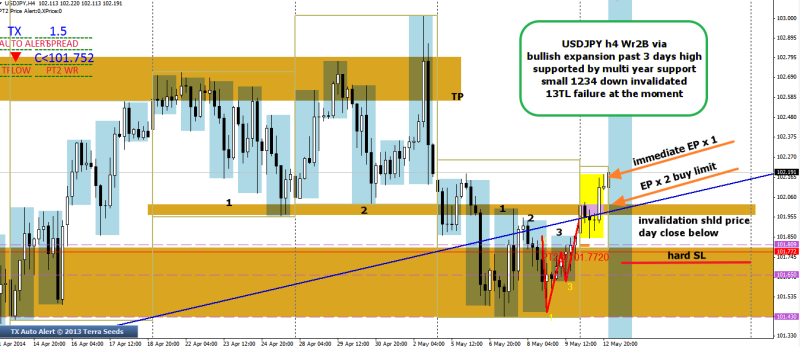

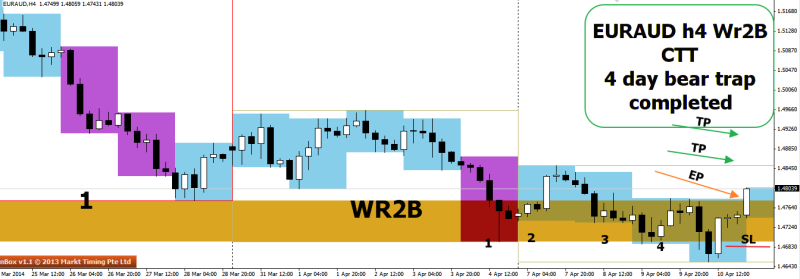

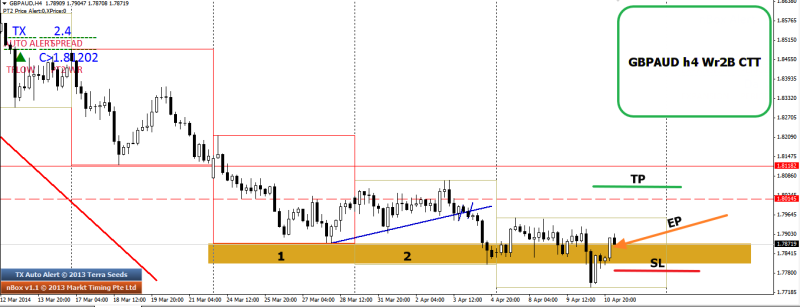

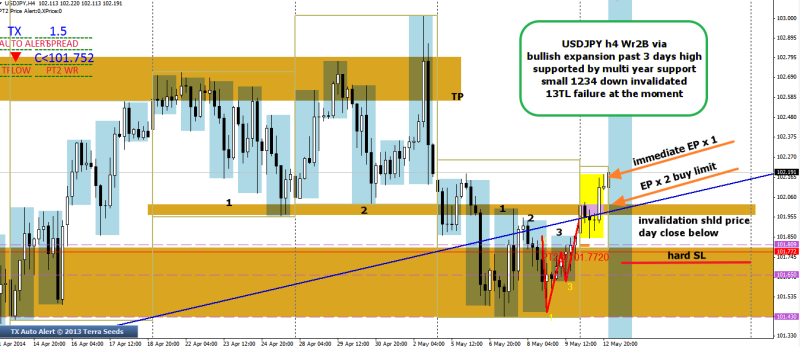

h4

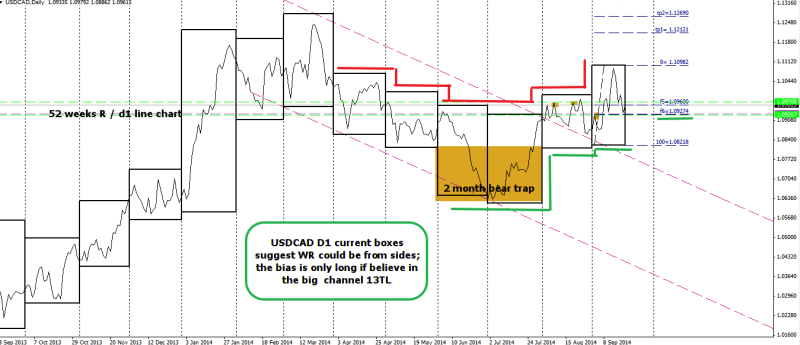

this pair completed a wr2b ranging via a bullish expansion day over 3 day high.

this bullish expansion can also mean a smaller accumulative pattern has been completed and price is now charging out of this consolidation.

This consolidation is perhaps due to support being found on multi year support + 13TL failure.

Any retracement is a short but a day close below this level invalidates this long trade.

I am expecting it to hit the box high.

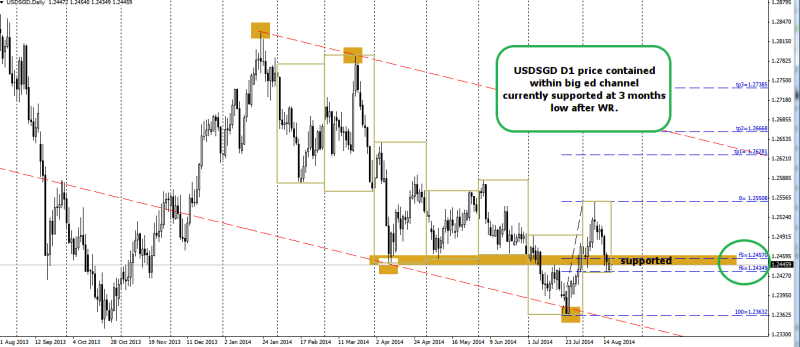

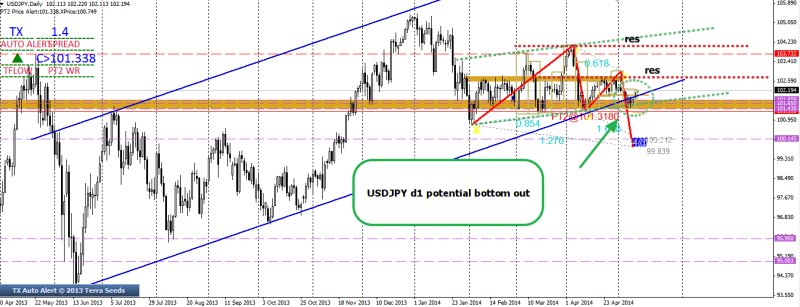

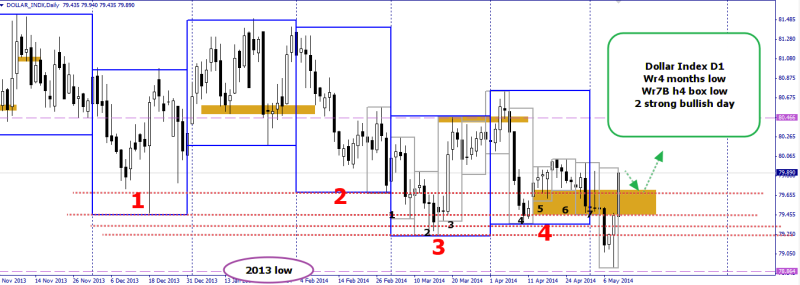

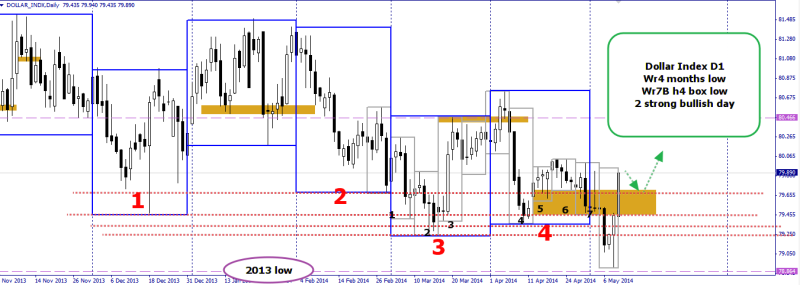

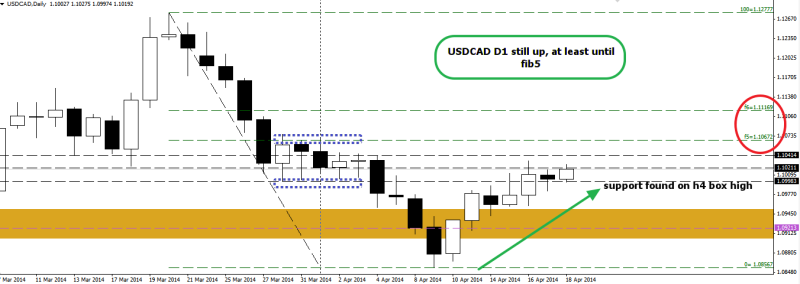

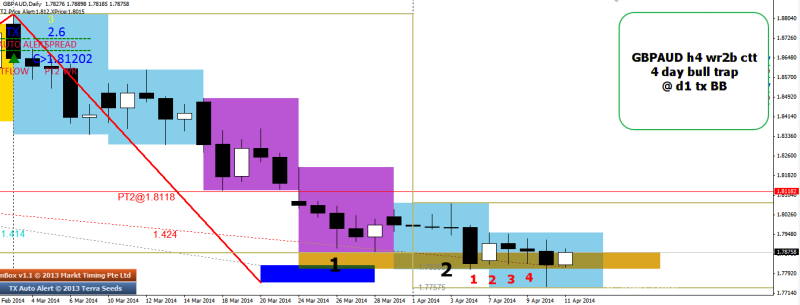

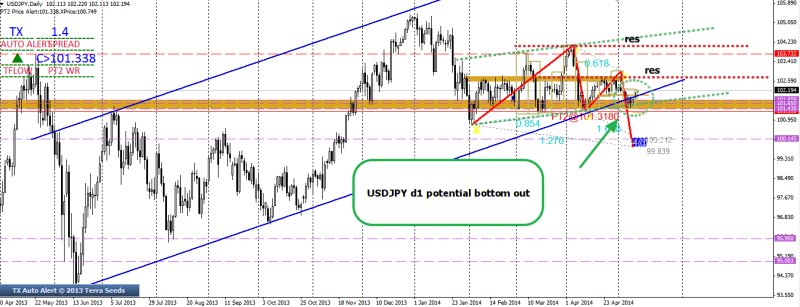

d1

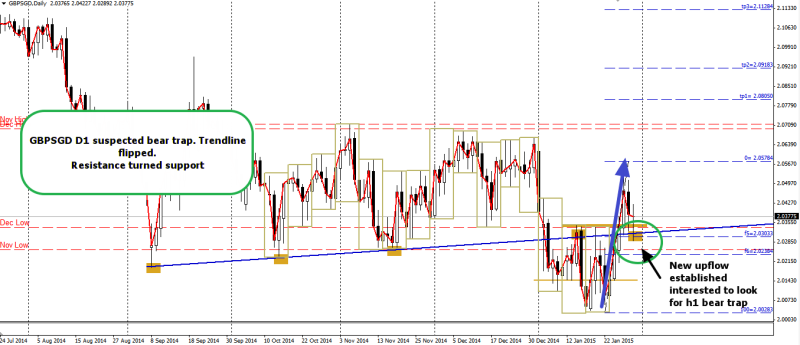

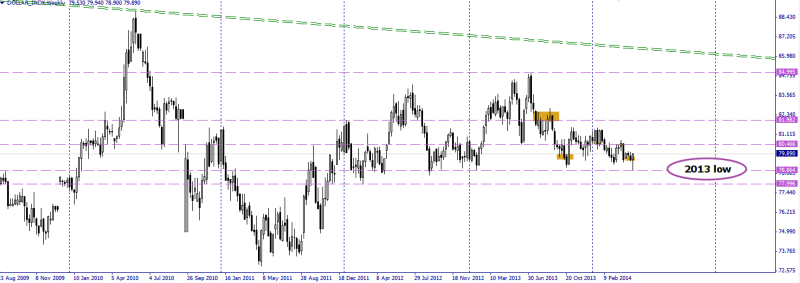

From the big picture, several things are suggested:

1- as from zig-zag pattern hypothesis, these patterns are usually formed when a head and shoulder pattern is completed and can be used to denote ‘stepping down’ action. However in this case this pattern seems to be having difficulty in being completed, at least for now.

So does failure of hns completion @ neckline = potential for higher move up?

2- the bottoming out is suggested by sentiment change in d1 candlesticks when a bearish expansion day charging into the multi year support turns into a bullish expansion bar after a few days. This screams bear trap. When aligned with big picture- it therefore suggests that 13TL is a failure , multi year levels holds as a support.

3- A long from here , suggests long entry is an early entry and has room for movement. Levels to watch will be 1: range high 2: Ed channel high

4- I can convert this strength in USDJPY to other crosses i.e AUDJPY , NZDJPY and continue to hold other crosses with confidence.

however, due to an overloading of positions already, and wanting to save margin for later part of the week for the best trade setup with highest edge, I am refraining from entering a large position.

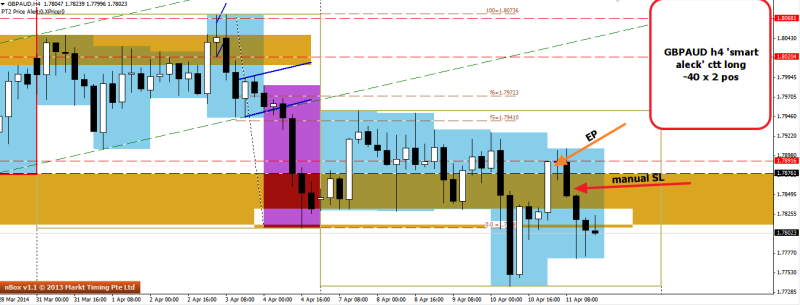

updated 170514

trade outcome +35

Another satisfying trade, as size was considerable for me and trade moved quickly and was exited quickly. I am working towards banking in profits quickly in this manner. For me, it is not really important to see how trade can last and if it is ” over 100+ pips+ or not.

Because when conviction is high for a trade and big positions are entered for a trade idea, pips does not matter that much more. It is more about trade moveability and how long I can exit this trade to book my profit, release the margin and move on to another trade.

Hence my mindset has begun to shift, which i thought had been effective since i have been booking profits more often with much lesser losses recently. Clearly, this strategy is working, contrary to what popular trading literature might have argued otherwise.

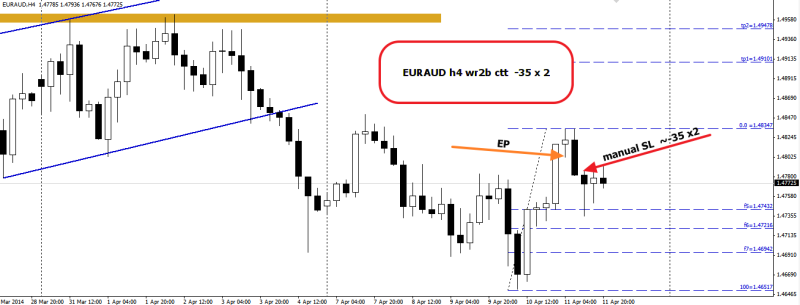

Good trade criteria to begin with

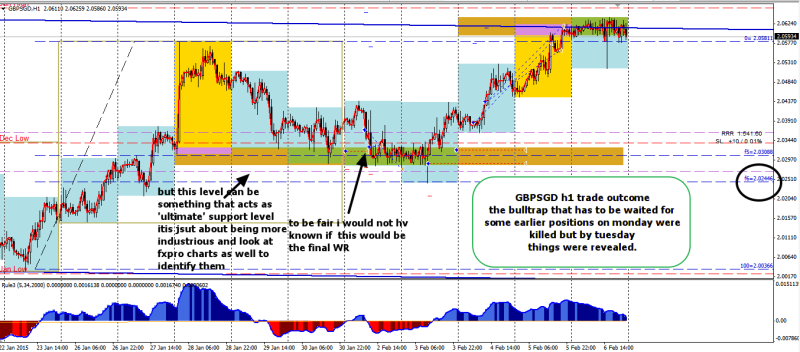

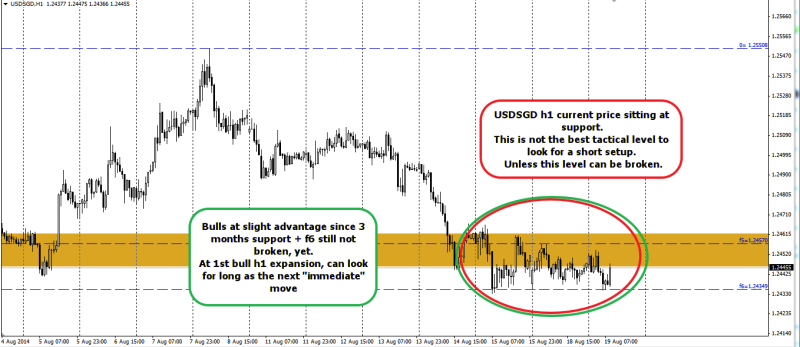

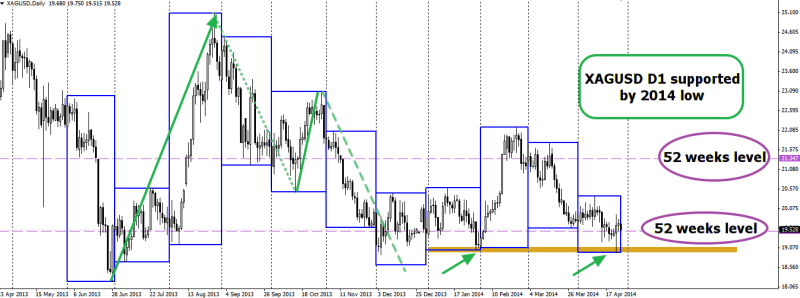

However, there were extremely good signals to begin with.

– blue to red expansion box indicate sentiment change

– this turn was due to df fib5 n fib6

– Also invalidation of a previous wr2b up

– upon retracement of this downflow towards fib6 was a shooting star, hit the trade.